Succentrix Business Advisors: Your Partner in Long-Term Business Success

Succentrix Business Advisors: Your Partner in Long-Term Business Success

Blog Article

The Benefits of Hiring a Specialist Organization Accountancy Consultant

Engaging a professional business accountancy expert can be a transformative choice for any kind of company. These specialists not just bring a riches of experience in monetary administration however additionally improve functional performance and critical preparation. By leveraging their understandings, businesses can browse intricate governing landscapes and reduce tax obligation responsibilities, therefore fostering lasting development. However, the advantages extend past mere compliance and performance; there are much deeper ramifications for long-lasting success that value exploration. What specific strategies can these experts carry out to tailor financial services that straighten with your company objectives?

Knowledge in Financial Administration

In addition, a proficient advisor can apply durable audit systems that offer precise and prompt monetary info. This accuracy is important for monitoring efficiency and making educated choices. By leveraging their expertise, services can boost their financial literacy, allowing them to analyze economic records and understand the ramifications of numerous economic strategies.

Moreover, the advisor's insight right into regulative compliance guarantees that services abide by financial laws and standards, lowering the risk of expensive penalties. They also play a pivotal duty in tax planning, aiding to lessen obligations and take full advantage of cost savings. Ultimately, the calculated advice and economic acumen provided by a professional organization bookkeeping advisor equip organizations to accomplish sustainable growth and keep an one-upmanship in their respective sectors.

Time Savings and Performance

Lots of businesses locate that partnering with a specialist business audit advisor leads to substantial time savings and improved functional effectiveness. By handing over monetary responsibilities to a professional, firms can reroute their emphasis toward core activities that drive development and advancement. This delegation of tasks permits business proprietors and supervisors to focus on critical initiatives instead of obtaining slowed down by daily bookkeeping functions.

Expert experts bring streamlined procedures and progressed software program remedies to the table, significantly decreasing the moment invested in accounting, tax obligation prep work, and compliance. They are adept at recognizing inadequacies and implementing best methods that not just conserve time however likewise minimize the risk of errors. In addition, their experience makes sure that due dates are fulfilled consistently, protecting against last-minute shuffles that can hinder efficiency.

With a professional audit expert taking care of monetary matters, organizations can stay clear of the anxiety of maintaining exact records and navigating complicated policies. This efficiency cultivates a more proactive and organized strategy to economic monitoring, eventually adding to better resource allotment and improved overall performance. Succentrix Business Advisors. This way, employing a bookkeeping expert not just saves time yet likewise boosts the performance of organization operations

Strategic Planning and Insights

A professional business accounting expert plays a critical role in tactical preparation by offering valuable insights originated from extensive monetary evaluation. Their competence makes it possible for services to comprehend their economic landscape, determine development chances, and make informed decisions that straighten with their long-lasting goals.

In addition, accounting experts can assist in circumstance preparation, reviewing potential end results of various tactical efforts. This Read Full Report insight gears up magnate with the knowledge to browse uncertainties and utilize on favorable problems. By integrating financial data right into the critical planning procedure, consultants empower organizations to craft robust business models that boost competitiveness.

Inevitably, the collaboration with an expert audit expert not only boosts the strategic planning process but additionally promotes a society of data-driven decision-making, placing services for sustained success in a significantly dynamic industry.

Compliance and Danger Mitigation

Conformity with monetary guidelines and effective danger mitigation are crucial for services aiming to keep functional stability and guard their properties. Hiring a specialist company accounting expert can significantly enhance a company's capacity to navigate the facility landscape of monetary conformity. These consultants are skilled in the newest regulatory demands, making sure that business follows local, state, and government laws, therefore decreasing the threat of legal challenges or costly fines.

Moreover, an expert consultant can identify possible dangers associated with economic techniques and advise techniques to alleviate them. This aggressive approach not only safeguards the organization from unexpected obligations however likewise cultivates a society of accountability and openness. By routinely conducting audits and evaluations, they can uncover vulnerabilities in monetary processes and carry out controls to address them efficiently.

In addition to compliance and risk administration, these consultants can provide valuable understandings right into best methods that line up with industry requirements. As regulations continue to evolve, having a specialized accountancy professional guarantees that services remain active and receptive, permitting them to concentrate on development and innovation while guarding their economic wellness.

Personalized Financial Solutions

Just how can businesses maximize their economic methods to meet special operational requirements? The answer depends on utilizing a specialist service accounting advisor who focuses on tailored economic services. These specialists evaluate the details challenges and goals of a service, enabling them to develop customized techniques that align with the company's vision.

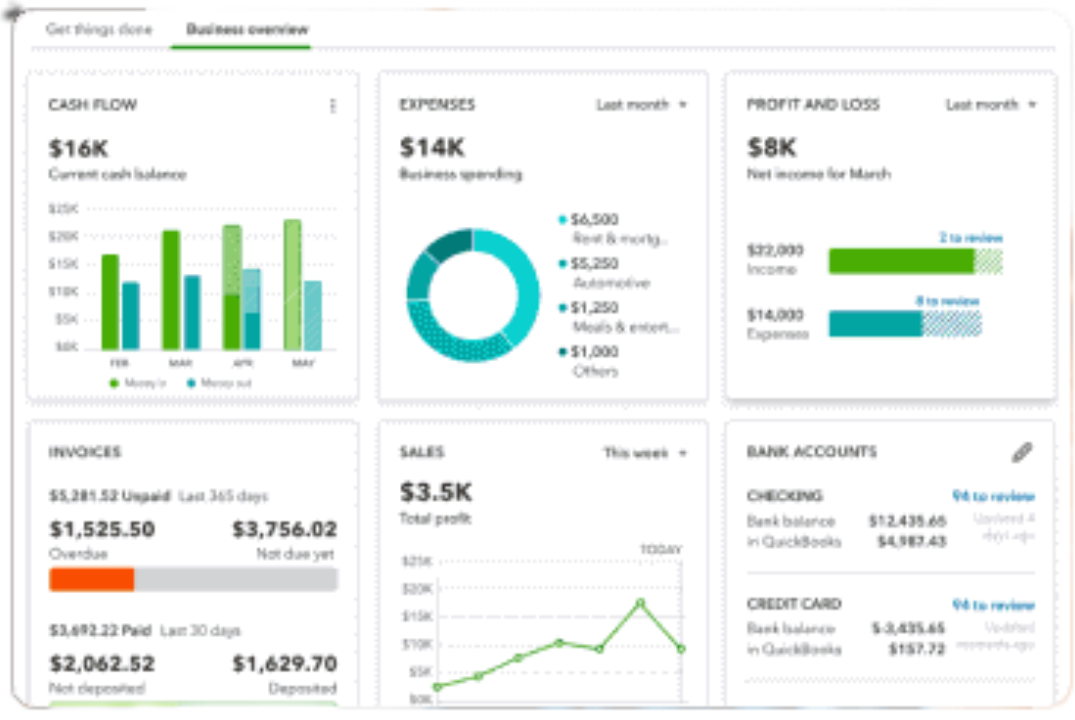

Personalized monetary solutions include a large range of solutions, consisting of cash money circulation management, tax projecting, budgeting, and planning. By assessing present monetary data and market conditions, advisors can create bespoke plans that take full advantage of profitability while lessening risks. This personalized approach makes sure that organizations are not simply following generic economic practices however are rather Full Article leveraging approaches that are particularly made to sustain their functional characteristics.

Additionally, customized remedies allow for versatility; as company requirements evolve, so too can the monetary methods. Succentrix Business Advisors. Advisors can consistently evaluate and readjust plans to reflect modifications in the marketplace, regulatory atmosphere, or business objectives. Inevitably, the support of an expert accountancy expert makes it possible for organizations to browse intricacies with self-confidence, making certain lasting development and economic health and wellness customized to their distinctive needs

Verdict

In conclusion, the advantages of hiring you can look here a professional service accounting advisor are diverse and extensive. Their effectiveness in conformity and risk reduction further safeguards businesses from governing challenges while enhancing tax obligation responsibilities.

A specialist business accounting advisor brings a wide range of expertise in financial evaluation, budgeting, and strategic planning, which are crucial components for sound economic decision-making. By leveraging their proficiency, organizations can improve their financial literacy, allowing them to interpret financial reports and comprehend the effects of various monetary approaches.

Eventually, the critical support and financial acumen provided by a specialist business audit advisor equip companies to attain lasting development and keep an affordable edge in their particular sectors.

Many organizations find that partnering with a professional service audit consultant leads to considerable time savings and boosted functional effectiveness. Ultimately, the support of a professional accountancy expert allows organizations to navigate intricacies with self-confidence, ensuring lasting development and monetary health and wellness tailored to their distinct demands.

Report this page